In the pursuit of homeownership, one of the most critical steps is securing the right mortgage. With a plethora of options available and numerous factors to consider, navigating the mortgage landscape can feel like navigating a complex maze. However, armed with the right knowledge and guidance, finding the perfect mortgage to suit your needs is not only possible but also empowering. In this blog, we will explore key factors and strategies to help you secure the best mortgage rate and terms tailored to your unique circumstances.

What is a mortgage?

At its core, a mortgage is a loan used to finance the purchase of a home. The borrower agrees to repay the loan amount, plus interest, over a predetermined period, typically ranging from 15 to 30 years.

Factors Affecting Mortgage Rates:

Several factors contribute to the determination of mortgage rates, each playing a significant role in shaping the borrowing landscape:

Credit Score: Lenders use your credit score to assess your creditworthiness. A higher credit score often translates to lower interest rates, while lower scores may result in higher rates or less favorable terms.

Debt-to-Income Ratio (DTI): This ratio compares your monthly debt payments to your gross monthly income. Lenders prefer borrowers with lower DTI ratios, as it indicates a lower risk of default.

Down Payment: A larger down payment typically leads to a lower monthly mortgage payment and may eliminate the need for private mortgage insurance (PMI).

Loan Term: The length of your loan term can impact your interest rate. Shorter terms often come with lower rates but higher monthly payments, while longer terms may have higher rates but lower monthly payments.

Type of Loan: When exploring mortgage options, it's necessary to understand the different types of loans available to borrowers.

-

Fixed-rate mortgages offer stability, with a consistent interest rate throughout the loan term, providing predictability in monthly payments.

-

Adjustable-rate mortgages (ARMs) typically start with lower introductory rates that adjust periodically based on market conditions, making them suitable for those expecting changes in their financial circumstances.

-

Government-backed loans, such as FHA loans and VA loans, offer competitive rates and flexible qualification requirements, making homeownership more accessible for many individuals.

-

Conventional loans, not insured or guaranteed by the government, may require higher credit scores and down payments but offer flexibility in terms and loan amounts.

Each type of mortgage loan has its advantages and considerations, so it's crucial to weigh your options carefully to find the best mortgage option for your financial situation and homeownership goals.

Strategies for Securing the Best Mortgage:

Improve Your Credit Score: Before applying for a mortgage, take steps to improve your credit score by paying down debts, correcting errors on your credit report, and avoiding new credit inquiries.

Save for a Higher Down Payment: A sizable down payment can help you secure a lower interest rate and reduce your overall loan amount, potentially saving you thousands of dollars over the life of the loan.

Compare Multiple Lenders: Don't settle for the first offer you receive. Shop around and compare mortgage rates and terms from multiple lenders to ensure you're getting the best deal.

Consider Government-Backed Loan Programs: FHA loans, VA loans, and other government-backed programs offer competitive rates and may have more lenient qualification requirements, making them suitable options for many borrowers.

Understand Closing Costs: In addition to the interest rate, consider the closing costs associated with each loan offer. These costs can significantly impact the total amount you pay at closing and throughout the life of the loan.

Utilizing Online Resources:

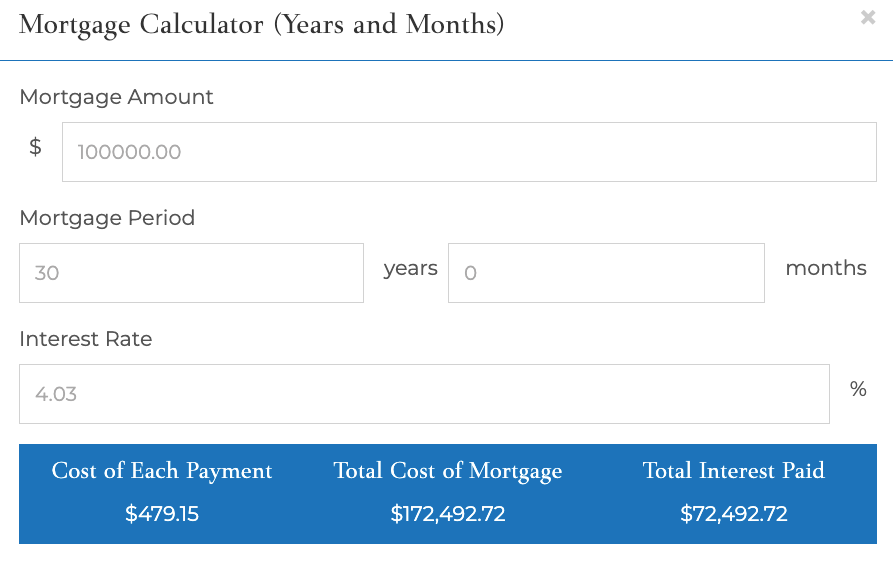

Take advantage of resources like an online mortgage calculator and tools to estimate your monthly payments, compare loan options, and determine how different factors, such as down payment size or loan term, can affect your mortgage rate and overall costs.

https://notemortgage.com/mortgage-calculator/

Consult with Mortgage Professionals:

Working with mortgage bankers or loan officers offers numerous benefits and can greatly simplify the mortgage process for you. These professionals serve as invaluable guides, providing personalized assistance and expertise every step of the way.

Expertise and Guidance: Mortgage bankers and loan officers possess in-depth knowledge of the mortgage market and lending industry. They stay updated on current market trends, lending regulations, and available loan products, allowing them to offer informed guidance tailored to your unique circumstances.

Access to a Wide Range of Lenders and Loan Products: Mortgage bankers typically work with multiple lenders, including banks, credit unions, and private lenders. This extensive network gives you access to a wide range of loan options, ensuring they can find the best fit for their needs and financial goals.

Customized Loan Solutions: Mortgage professionals take the time to understand your financial situation, goals, and preferences. Based on this information, they can recommend loan options that align with your budget, credit profile, and long-term objectives.

Streamlined Application Process: Mortgage bankers and loan officers streamline the mortgage application process by gathering necessary documentation, completing paperwork, and liaising with lenders on your behalf. This saves you time and reduces the stress associated with navigating the mortgage process independently.

Negotiation and Advocacy: Mortgage professionals negotiate with lenders to secure favorable loan terms and rates on behalf of their clients. They advocate for your best interests throughout the mortgage process, ensuring they receive competitive offers and favorable treatment from lenders.

Ongoing Support and Communication: Mortgage bankers and loan officers provide ongoing support and communication, keeping borrowers informed at every stage of the mortgage process. They address any questions or concerns that arise, providing reassurance and guidance until the loan is successfully closed.

To get in touch with a loan officer today visit https://notemortgage.com/contact/

Securing the best mortgage rate for your situation involves careful consideration of various factors, from credit score and debt-to-income ratio to loan type and down payment. By understanding these key elements and employing strategic approaches, you can increase your chances of securing the best mortgage rate and terms that align with your long-term financial goals. Remember, the journey to homeownership is unique for each individual, and with diligence and informed decision-making, you can confidently navigate the mortgage maze and embark on the path to your dream home.